Many of us are depending with trepidation on Social Security for our retirement years. It’s not that we want to depend on Social Security; it’s that we don’t have any other option. We don’t have retirement from the companies we’ve worked for; we don’t have fully-funded retirement accounts; and we don’t have the money we need sitting in bank accounts or investments.

The problem is, Social Security was never intended to be the only source of retirement income for senior citizens. The plan was based on providing 40% of a retired person’s income, not 100%.

Yet it is often a much higher percentage of a retiree’s total income, simply because they don’t have other sources.

With this in mind, it just makes sense to get the most out of your Social Security benefits. That means getting the biggest payments possible, so that you have enough to live on.

How Much Did You Make?

As with anything else that government bureaucrats control, your actual Social Security check depends on a formula that is used for calculating your benefits. There are several important factors which are used to determine how much you will earn at retirement.

Of these, the top three are:

- How much you made during your working years – Your total earned income affects how much you and your employer(s) have paid into Social Security, which ultimately affects how much you receive. The more you’ve earned, the larger a check you will receive.

- Your age at retirement – The longer you wait to file for Social Security, the more you’ll earn. We’ll talk more about this in a moment.

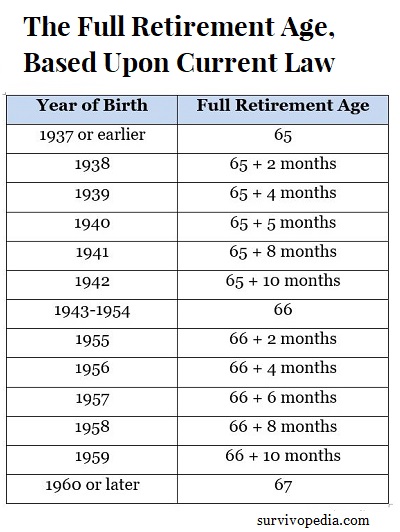

- What year you were born – The “full retirement age” has changed over time. So the year you were born affects the age at which you are eligible for full retirement. Retiring before that age reduces your benefits.

Since Social Security is intended to pay a “portion” of your retirement, the amount you earned during your working years is important. Social Security assumes that you will work for 35 years, so any year that you do not work ends up counting as zero earnings. Of course, of you work more than 35 years, that’s not an issue; it’s only an issue for the years that you learn less.

While I’m sure that you have been trying to earn as much as you can throughout your working years, the amount you earn in your last years is especially important.

For comparison sake, I ran my own numbers on Social Security’s online Retirement Estimator. A $10,000 a year difference in earnings from now till I reach retirement age in seven years, works out to a difference of $106 per month once I retire. I chose a $10,000 a year difference, as that’s about what I could earn with a part-time job.

If you are planning on starting a retirement business, it would e worthwhile to start working on it now and add to your current income and subsequent Social Security benefits. Granted, you’ll end up paying more in taxes as well, but you’ll still end up with more in your pocket; and that’s what matters.

But Watch Out for This in Your First Retirement Year

While I’m a firm believer in retirement businesses, you have to be careful how much you make… at least during the first year of retirement. There’s a cap on how much you make that year, before it affects your Social Security benefits. That cap is somewhere around $16,000.

One way around this is to put your retirement business in someone else’s name, like your spouses. If you aren’t the same age or don’t retire at the same time, your spouse can earn the income from your business that first retirement year, then transfer the business over to you for subsequent years. That way, they won’t have that income showing up their first year of retirement.

When You Were Born

Once upon a time, the normal retirement age was considered to be 65. Actually, that was the understanding for a long time. But in recent years, that’s changed. Not only have companies been changing their retirement policies, but the Social Security Administration has been changing what it considered to be the age of retirement.

While you can file for and start receiving Social Security retirement benefits at 62 years of age, full retirement is based upon the year you were born. This is important, because early retirement (at 62) reduces your monthly income from social Security by about 30 percent.

So, let’s take a look at the full retirement age, based upon current law:

If you apply for Social Security benefits at 65, you won’t get full benefits; they will be reduced by some percentage. You would have to wait a year, until you are 66 and apply then, in order to be able to receive full benefits.

What can I say; one more way in which your government is serving you.

Your Retirement Age

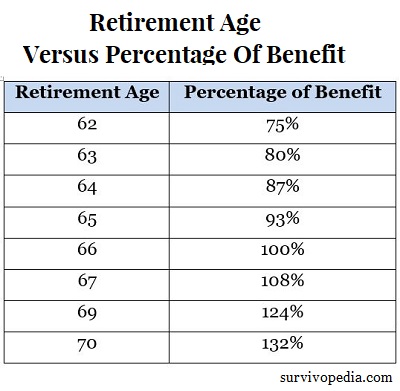

The biggest factor in determining how much you’ll receive in Social Security benefits is how old you are when you apply for them. Each year you retire before your full retirement age reduces your benefits from five to seven percent.

But the opposite is true as well. Each year that you wait, after reaching full retirement age will increase the amount you receive per month.

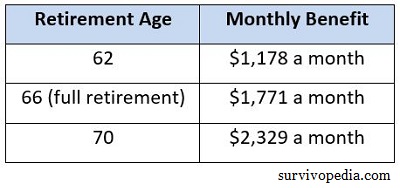

Take a look at this chart:

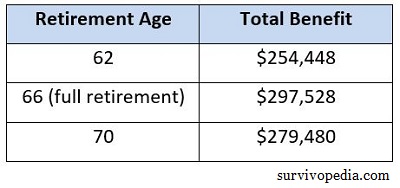

As you can see, we’re talking a huge monthly difference between retiring at 62 and retiring at 70. To put some real numbers on that, just for comparison’s sake, let’s look at a theoretical person’s monthly Social Security benefits upon retirement:

For comparison’s sake, the average Social Security benefit paid per month is $1,342 and the maximum amount that can be paid is $2,687 a month. As you can see, our theoretical person will be making a little less than the average, if they retire early at 62.

But they will make almost the maximum if they wait until 70 to retire.

These numbers actually work out to roughly the same amount of total Social Security benefits, depending on when the individual dies. If we assume that this theoretical person dies at 80 years of age, their total Social Security benefit works out to:

In that case, the maximum benefit is actually realized by waiting until age 70 to apply for Social Security. Waiting longer doesn’t add anything to this amount, but applying earlier reduces the monthly income received.

Of course, you have to take your health into consideration on these decisions. If you are in good health, there’s no reason why you can’t live to 80 or older. But not everyone does. Some die considerably younger.

So if your health is not good, you might want to consider taking the younger retirement, even though you won’t receive as much of a Social Security payment per month.

Spouse’s Benefits

If you are married and die, your spouse is entitled to receive your Social Security benefits, or if they die, you are entitled to receive theirs. But you can only receive one. Your spouse can’t receive theirs and yours both, they have to choose between one and the other, obviously the one that will give them the larger payment.

One way to handle this, so as to get the most overall benefit, is to have the spouse with the lower expected social security benefit retire either at 62 or their full retirement age and the spouse who is going to receive the larger Social Security benefit retire at 70. What this does is leave the larger retirement in the pot longer, increasing the payments made when they are finally applied for.

Let me give you an example, using the same figures I’ve used above, with a couple who are both the same age. One spouse retires at 62, receiving $1,178 per month, but the other spouse doesn’t apply for Social Security, or applies and asks that their benefits be put on hold.

Then, regardless of which spouse dies first, when the survivor reaches 70 years old, they switch to the retirement of the other spouse, upping their monthly income to $2,329 per month.

There’s a lot of strategy that you can use in this, if you take the time to think it out. The big thing to do is to use the Social Security Administration’s online Retirement Estimator to determine how much you will receive, in a number of different scenarios.

Then, based on that and your other income, you can make the decision of what will work out best for you!

This article has been written by Bill White for Survivopedia.

What about a situation where you have kids late in life, and have children under the age of 18 at retirement age?